Rahkar Tejarat Paya Company professionally performs all matters related to the clearance of goods from different customs of the country for its customers.

If you want to import the goods and clear them, contact our experts through the contact page to guide you.

In general, customs clearance is done in several ways. Depending on what stage of the import the customer intends to leave the work to us, we consider a specific process for it.

The following is a complete description of the clearance process and any points that an importer needs.

This article was updated on December 10, 1400 with updated information.

What is a clearance?

Clearance is the process by which your imported goods must go through certain steps in order for the goods to be cleared through customs.

These steps include customs and financial processes and obtaining the necessary permits.

In other words, you bought a product from abroad

The goods have entered customs

The process of removing goods (customs clearance) from customs during the legal process is called clearance.

Clearance in English

The word clearance is translated into English as Clearance.

It is also called Customs Clearance.

Customs clearance steps

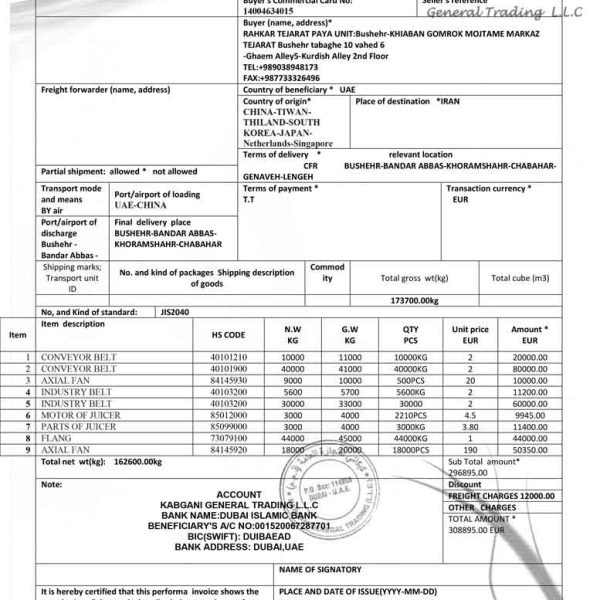

- Obtaining proforma from the seller

- Action to get ntsw order registration

- Request for foreign exchange allocation from the Central Bank

- Remittance for the purchase of goods

- Bill of lading process and transportation of goods to Iran

- Estimate the cost of customs clearance

- Obtaining clearance from the shipping company and warehouse receipt

- Register goods in epl system and get cottage

- Determining the route

- Customs deposit (entry fee)

- Deposit 4% tax on account (no need to pay in case of exemption)

- Obtaining the required permits

- Get tracking code from operating bank

- Electronic licensing

- Calculation of warehousing fees

- Truck arrival and loading of goods

- Re-check the goods from the customs exit door circle

- Exit of goods and delivery of goods to the warehouse mentioned in the epl system

In the following, we will review all these steps. Stay with us .

1- Obtaining proforma invoice (pre-invoice) from the seller

The first step for customs clearance is the stage of receiving proforma. Before purchasing the goods and registering the final invoice, you can receive the pre-invoice from any supplier company by providing the product specifications.

In this document, important issues such as payment methods, commitment of the parties, cases related to Incoterms, etc. are specified, which can be checked for you and the seller. In fact, it is a pre-invoice to check the import of goods into the country. To find the source of buying goods, different merchants and people use different channels to find sellers, such as:

- Common Chambers of Commerce,

- Yellow Pages (known in Iran as the first book and is a complete and comprehensive directory of telephone numbers of various businesses),

- Alibaba site

2- Applying to receive ntsw order registration (comprehensive trading system)

After receiving the pre-invoice from the seller of the goods, it is time to register the order. (Or the same import license from the Commercial Office)

The most important point in registering an order for goods clearance is to have a business card.

For complete familiarity with the terms and conditions of a business card, click on the link opposite: zero to one hundred business cards

Before buying the product you are looking for, you should consider a series of items. For example, you should know that the goods you are going to buy now are considered prohibited goods or are on the list of support for domestic products.

After receiving the form and uploading it to NTSW, you will make an official request to import the product you want. Among the items that should be considered in the order registration stage, we can mention tariffs, valuation (TSC), priorities, etc.

Comprehensive trade system site address: Click.

Rahkar Tejarat Paya Co with more than 20 years of experience, provides you with the following Shipping purchased goods A person purchases the desired product from the country of the manufacturer and imports the goods in the following ways:

- Importing goods through sea to the ports of the country.

- The goods are shipped by air to all Iranian airports with cargo.

- Goods purchased from European countries enter the country via the Bazargan customs through the land.

col Obtaining an import license from the Department of Commerce” At this stage of clearance, we must first obtain the relevant license from the Department of commerce. The licensing process is one of the most important steps. Before taking any actions, you must ensure that the license is issued by the Department of Commerce.

- First, you need to register a product proforma invoice at www.ntsw.ir

- Then, obtain a license from the Department of Commerce.

At this stage, we are licensed by the Commercial Card (Permit) of the importer company. Investigating the requested goods license In the next stage of customs clearance, we first need to examine the prohibition on imports of the intended goods. For this investigation, we ask the customer to provide us the HS code (a standardization system for product classification and identification).

The customer may not be aware of this code or the seller may not provide the tariff code. We can find this code for your goods. Then we start the licensing process according to the packing list (details of the cargo including volume, weight, so on.) and the invoice we receive from the customer. Estimation of the cost of clearance ustoms duties are defined as the percentage of the total value of the invoice taken from the owner of the goods according to the amount set by the Ministry of Mines, Industry, and Commerce, which is modified at the beginning of each year.

We obtain the value of the goods in the TSC system. This system is declared by the value and customs department and its purpose is to examine the value of the intended product according to the country of the manufacturer and the brand.

Here we determine the cost of the customer’s packing, for example, with 30 CBM volume and 100kg weight with the specified invoice, i.e.

After investigating all the above items, we inform the customer about the final price. If confirmed, we can get started. Issuance of Bill of Lading (BL) A bill of lading is a document that is of great importance, especially when claiming insurance coverage.

The contents of the bill of lading include:

- seller of goods

- Container number

- Number of packages available per container

- …

For the customs clearance process, after the customer’s confirmation, a BL is issued for the import and is delivered to us. Negotiable Warehouse Receipts (N.W.R) After the goods are loaded in the customs, they must be unloaded prior to delivery to the warehouse.

Warehouse Receipt is issued after importing, unloading and matching.

This Receipt contains the following information:

- Name of the owner

- Product Type

- Packing

- …

Customs Declaration and Getting a Quotation Now, we login on the customs website (EPL.IRICA.IR) for importing the goods after obtaining a license from the Department of Commerce.

Then we register the customs declaration of the intended goods. The corresponding customs expert examines the import declaration and informs us using the system. If it needs to be corrected, He informs us through the Declaration message.

This process continues until a confirmation is received and the Declaration is sent to the next step. Obtaining the required import After the customs clearance and after we sent the customs declaration and received the registration, Depending on the goods, there is a set of required licenses.

For example, importing foods requires a health certificate. Other licenses include:

nature , Department of Defense , environment and …The final step of loading After obtaining complete confirmation of the customs expert, we should obtain the required Certificate of loading.

With the customs certificate given by the customs system, we go to the customs office in person.

After receiving the Certificate of loading, the goods are loaded and sent to the customs exit gates.

This is where the expert in exit gates checks the declaration procedures and allows the goods to exit. customs Clearance ends at this stage.